News analysis

Should Tesla do anything about Elon’s tweets?

Twitter enables immediate communication. Anyone with a Twitter account can speak to the world. One of the consequences of this is that boardroom directors can speak directly to customers, staff, other boardroom directors and, indeed, any and all stakeholders. Is this a good thing? In this short discussion, let’s use the example of Elon Musk and ask – should Tesla do anything about Elon’s tweets?

On 7th August 2018, the CEO of Tesla sent the following two tweets, surprising the tech world with what appeared to be a fait-accompli regarding fundraising and taking the company private.

By the end of day, TSLA shares rose 11%, hitting $381 per share (still a way off the projected $420).

Musk later tweeted that investor support for the plan was “confirmed” but contingent on a shareholder vote.

These tweets came shortly after Financial Times reported that the Saudi Arabia sovereign wealth fund bought a $1.9 billion stake in Tesla.

At the time, Tesla was under pressure from Short Sellers of the TSLA stock, and Musk was rightly pi**ed off with the stock market dynamics and shareholder manipulation (to say the least). Here’s what he had to say at the time:

“As a public company, we are subject to wild swings in our stock price that can be a major distraction for everyone working at Tesla,” he wrote. He also blamed the “quarterly earnings cycle,” which puts “enormous pressure on Tesla to make decisions that may be right for a given quarter, but not necessarily right for the long-term,” and the large number of short sellers “who have incentive to attack the company.”

(Note that, since August 2018, the Tesla stock price has increased over 10-fold!)

Elon Musk is an incredible innovator with a fierce work ethic and is a big picture dreamer. Stylish electric cars and space travel for the ordinary Joe Soap (with a big bank balance) are part of that dream.

Like many US firms he is the Chair (President), CEO and the largest shareholder.

Musk was fined as a result of these tweets.

In February 2019 (6 months later) Tesla said that it “substantially paid by the end of 2018” the pretty small $30 million in settlement and legal expenses related to Musk’s public statements about a plan to take Tesla private, which did not materialize.

So, what’s going on here? In short, the board of directors allowed another member of the board to make a unilateral decision to communicate with the market, which resulted in altering the share price (to his personal benefit).

Over a year later, in December 2019, Musk stated that his net worth was approximately $20 billion. Today, Forbes estimates his personal worth in excess of $140 billion.

His tweet to say he was going to “take the company private with funding secured” raised a few eyebrows, not only with his board but with the investment and regulatory communities.

So, in retrospect, did he do the right thing or was he simply manipulating the markets for his own personal gain?

And what should the board have done about this (at the time they effectively did nothing)?

Here are a few things that they might have considered as part of the process.

- Remove Elon Musk as Chair and replace him with an independent chair from within the current board or bring in a tried and tested outsider. Of course, Musk is the driving force behind Tesla (and a number of other successes), so doing this might well have risked the success of the company. There is also the likelihood that the directors had an equity stake in the company. As the shares were on the rise at the time (nobody could have predicted what was to come!), this would have been a risky act.

- Introduce a policy on Twitter and directors, describing who can tweet about what and when, whether on financial or other matters. Should the boardroom directors be allowed to communicate in such a matter that causes the value of the company to be altered? On one hand, we all want our own businesses to increase in value, but at the same time we have to be very cognizant of the impact of what we say to the cariou stakeholders.

- The Tesla board could have introduced a board rotation policy. This would ensure that the chair (and other directors) can only serve on the board for a given length of time.

There is no easy solution to this matter. Elon Musk is an entrepreneur, an innovator and value creator, so one will want to keep him motivated and focused. His skill set is probably not being the Chair of a public company and all that goes with it. So, some compromise must be found to rebuild trust in the governance of the organisation.

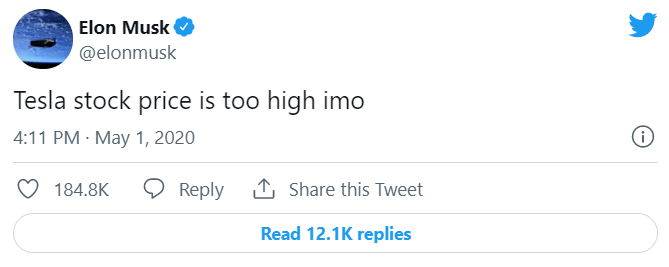

Nearly two years after the above tweets, on May 1st 2020, Elon Musk was in the bad books once again when he sent out the following tweet, stating that the Tesla share price was too high.

This tweet caused many investors to exit the company, wiping $14 billion off the company valuation.

Perhaps the correct action, therefore, was indeed to do nothing. Maybe Musk’s tweets simply balance things out in the end, with the shareholders (and Elon Musk) being the main benefactors as the value of the company continues to rise.

Is there a compromise somewhere between Twitter and directors? Should communications be limited? Is Twitter simply just another sales channel for directors and leaders?

What do you think?

Once thing that did happen as a result of the tweets in August 2018, triggering an SEC probe, is that Elon Musk stepped down as chairman of Tesla.